I have said more than once that we need to fundamentally change the way wealth is distributed in our society. I am not the first to say it, and I won’t be the last. Workers produce more and more, and the workforce as a whole is harmed by that trend. All the wealth they are creating goes into the pockets of a few at the top.

In the 1930’s, as banks failed and people lost access to food and shelter, many movements came up with ways to solve the problems that unfettered capitalism had fomented. Socialism and Communism gained in popularity, along with Fascism, which had a bit of a heyday not long after. In the mix were also some more wackadoodle ideas like Technocracy.

Technocracy is named more like a government system, but is mostly about economics. Based on the assumption of continued increases in worker productivity, the response is a very healthy “if people are more productive, they don’t need to spend so many hours producing.” So far, so good!

There is no money in the Technocratic State. Periodically each person is given a certain number of credits. They are not transferrable, and expire. When you go to the store and buy something, the credits you spend are not transferred to the vendor, they simply cease to exist. Shortages and surpluses are not the vendor’s problem.

Prices are controlled by the state, based on the energy required to create the thing. However that would work.

Before I get to some of the more wackadoodle parts, let me mention a couple of less-bad things about Technocracy. The credit distribution is essentially Basic Universal Income; everyone gets what they need. There are no billionaires; no one-percent. Wealth cannot be accumulated; all credits expire. Increased productivity means more for everyone, and more leisure time. Basing the pricing on energy consumed means that the environmental cost of the full lifecycle of an item can be built into the price.

I wrote once (I would include a link but I can’t find it… this blog is big!) that if you could make the cost of purchase of a widget include the cost of mitigating the environmental impact of producing, shipping, using, and disposing of it, there would be no need for any other environmental regulation. Products that pollute less will cost less.

In that same episode I pointed out that such a system was impossible to implement. The government would have to determine the environmental harm tax on every damn thing. The government would have to be swift, efficient, and not subject to second-guessing.

Technocracy solves that problem by getting rid of Democracy along with money. Instead, dispassionate, unbiased engineers would run the show. In this particular autocracy, decisions about the economy would be made by people who recognize that without money the economy is just a machine. They would make the best choices because they are smart and not swayed by greed or politics. They are engineers, dammit, immune to the frailties of humans.

Edison and his ilk were heroes back then; these were the people who should be running things!

Get your chuckles in now; things might turn scary later.

Let’s not even get into how innovation happens in this environment — presumably the engineers in charge will be able to judge every idea and allocate the appropriate resources, with the sole goal to increase worker productivity balanced against energy cost (and state security) further.

One of the core tenets of currency is fungibility. Any dollar is worth the same as any other dollar. All dollars are interchangeable, so they can just as well be numbers in a bank’s computer. The technocrat’s credits are non-fungible: they each are unique and limited in utility and duration. The techno-cretids are, quire literally, non-fungible tokens, or, as the kids say, NFT’s. Put that in your pocket for a minute.

Anyway, no money. Which makes it hard to deal with any economy that still uses money. The answer from the Technocracy proponents was (is?) simply this: don’t. Even back in the 1930’s this was already a stupid and unworkable idea, but the Technocracy proponents wanted to create an absolutely isolated nation that had all it needed, and was surrounded by physical and military walls. No trade, no tourism, no diplomacy.

This proposed nation involved the United States annexing Canada, Greenland, and Central America at least as far as the Panama Canal; preferably further.

Huh. That’s an interesting list, these days. Greenland?

Something else that is interesting: Elon Musk’s grandfather was an active proponent of this nonsense back in the day.

Perhaps it is coincidence that Orange Julius Caesar wants to annex Greenland and take back the Panama Canal. But seriously, Greenland? Perhaps the shift toward isolationism in our diplomacy is not simple stupidity, but stupidity informed by a larger, even stupider goal.

We can be damn certain that OJC loves being rich, but maybe that just means Elon hasn’t told him the whole plan yet. More likely Elon and OJC have built into their plans a way to be far more equal than everyone else in the new regime – they will preserve the billionaire class.

Maybe you’ve already thought of this, but that hypothetical council of wise, unbiased engineers that is supposed to run things? Elon has already fired them. In his drug-addled brain, our new overlord will be AI. Programmed by Elon and his bros, carefully trained to advantage Elon and his bros.

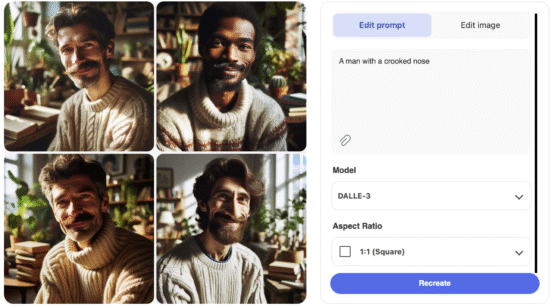

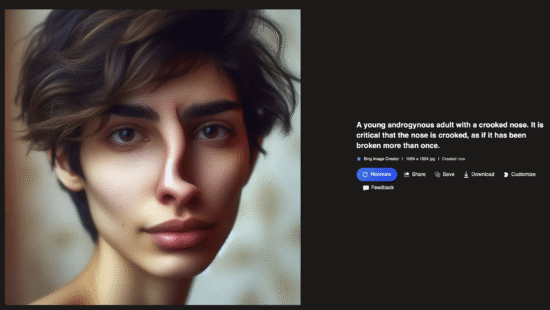

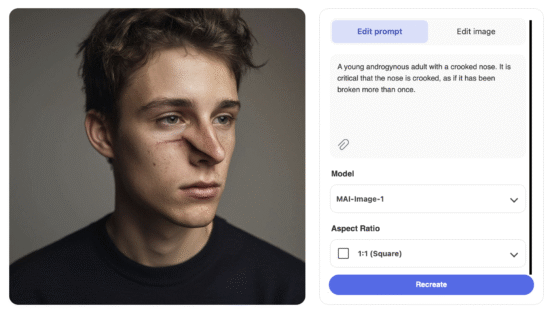

You would have to be seriously high all the time to think something like that could work, but… Elon. He’s already trying his fizzy-brained best to replace at least some of our government with generative AI. If you credit him with having enough brain to form an endgame, replacing money with NFT’s and government with an AI he controls seems like a good candidate.

Am I saying that Elon Musk is a drug-addled idiot eager to adapt the overt racism of one side of his family and the elitist ideals of both to use his wealth to compel a simpering sycophant president to create a world to his liking? Am I saying that the current President of the United States is the simpering sycophant mentioned above, and who like a starving dog will follow any plan as long as it leads to personal profit?

No. Clearly I am not saying that.

3

3

Sharing improves humanity: